Concerns about DeepSeek caused Nvidia‘s stock to plummet, resulting in a $589 billion decline in market capitalization. The largest one-day decline in a company’s valuation. Anant Raj is one of India’s top data center companies. Netweb is a manufacturing partner of Nvidia.

According to G Chokkalingam, the founder and director of Equinomics Research. The correction in these growth-driven companies is not surprising and was expected given their high valuation. These counters’ bottomline growth was significantly out of line with their values. Even well-run businesses require accurate appraisals and might not be able to support premiums.

Domestic companies including Anant Raj, Netweb Technologies India. Zen Technologies had a 20% decline in Tuesday’s trading session due to the increasing selling pressure in AI-driven businesses. Due to the recent unfavorable news flow and increased selling pressure in the larger markets. These equities have fallen 40–50% from their 52-week high.

These stocks have been impacted by the recent decline in Nvidia shares following the launch of the Chinese AI start-up DeepSeek. DeepSeek asserts that it is a free substitute for ChatGPT, building models with fewer chips and at a lower cost.

American stocks fell Monday, and chipmaker Nvidia‘s market worth fell by around $600 billion. After a surprise breakthrough from DeepSeek, a Chinese artificial intelligence startup, called into question the idea that America’s technical sector was unrivaled.

Last Thursday, the one-year-old startup DeepSeek released an incredible feature. It introduced R1, a ChatGPT-like AI model with all of the familiar characteristics at a fourth of the cost of well-known AI models from OpenAI, Google, and Meta. In contrast to the hundreds of millions or billions of dollars that US corporations spend on AI technology. The company claimed to have only invested $5.6 million in computing power for its base model.

Tech stocks decline

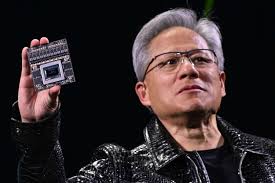

Leading AI chip provider Nvidia (NVDA) saw an almost 17% decline in market value. Losing $588.8 billion. This is by far the worst market value loss in a single day for a stock. More than doubling the previous record of $240 billion established by Meta almost three years ago.

To put things in perspective, Nvidia’s market value dropped more on Monday than the combined value of all but 13 firms. After its shares more than doubled in the last two years, Nvidia started the day as the market’s most valuable publicly traded stock, valued at nearly $3.4 trillion. It finished the day in third place, after Microsoft and Apple.

Google, and Meta also had significant declines. Marvell, Broadcom, Micron, and TSMC. Nvidia’s rivals, also saw steep declines. Several data center and energy firms, including Oracle (ORCL), Vertiv, Constellation, and NuScale, fell.

Since tech stocks account for a sizable portion of the market. Tech makes up roughly 45% of the S&P 500, according to Keith Lerner. An analyst at Truist—that hurt the overall stock market.

On Monday, Nvidia‘s market capitalization dropped by about $600 billion. The worst decline for any corporation in a single day in American history.

The stock price of the chipmaker fell 17% to settle at $118.58. Since March 16, 2020—early in the Covid pandemic—it was Nvidia’s worst day on the market. Nvidia’s shares fell Monday, leading a 3.1% decline on the tech-heavy Nasdaq. After the company overtook Apple as the most valuable publicly traded business last week.